Share this

Activate your social listening platform to discover customer interests

by Infegy Research Team on October 20, 2022

Our eBook, 10 Ways to Use Social Listening, generated a buzz of enthusiasm and curiosity among our clients! We’ve written this blog to dive deeper into questions we received – specifically, regarding how to leverage social media data to determine customers’ interests.

The race is on to better understand consumers and consumer behavior in order to keep up with your industry and stay ahead of competitors.

Like many, you probably are seeking out new ways of predicting your target’s buying behaviors, pain points and path to purchase. This creates an interesting challenge that social listening is positioned to help solve.

What if you could take all of the people who are talking about your brand, who follow along or interact with you, who have trust in you, or who show purchase intent in your products, etc. then figure out what topics and hobbies they are interested in?

Social listening tools offer that kind of insight. With social listening platforms, you can discover some incredible insights that can help you find more answers to questions about your audiences. This is where brands and agencies have a largely untapped opportunity to learn about the people they want to reach and connect with.

Research and analysis of social conversations can lead you to discover target audiences’ interests that will empower your teams to make big business decisions. More importantly, social listening tools can help you answer an even bigger question: what is your target market passionate about?

We’ll now take you through this technology and how to leverage it to research your audience interests and we’ll show you how you can apply these insights to your strategy.

Why use social listening to discover your audience’s interests

Social listening tools are artificial intelligence-driven software platforms, which analyze the entire web – from social media sites, to blogs, review sites, news, and forums. Analytic processing within the platform can then identify and display specific audience segments, and pinpoint other topics these people talk about and are passionate about.

By correlating this information to your (or your clients’) brand or business, you can get a better understanding of your target consumers and what drives their behavior.

This could be especially helpful for:

- Building audience personas and customer profiles.

- Helping shape your message around relevant topics for your audiences.

- Targeting your digital ads.

- Placing your ads and media in the right place to reach the right people.

- Building personal connections with relevant people at scale.

Social listening tools allow you to research your audiences and analyze the topics and categorical terms they are interested in. This enables you to formulate the right strategies and approaches to campaigns, messaging, product improvement and digital content. It can also help you gauge customers’ interests in products.

So, how do you leverage social listening to discover these key insights about your target audiences?

In this blog, we’re going to look at how you can use social media intelligence to research your audience interests. We’re going to use our social listening platform, Infegy Atlas for this overview. We'll also offer some insights on how you can apply these insights to your strategy and build passionate customers.

If you would like to tour the platform first-hand, request a free custom demo.

How To Analyze Audience Interests

The best social listening platforms have audience interests analysis capabilities.

Let’s say you’re conducting research for Whole Foods; you’ll want to know what this brand’s audiences and customers are interested in, and what they are passionate about so that you can better understand them. Once you have an understanding of Whole Foods’ audience, you can use that to inform your strategy and planning for the brand.

After crafting and running an Infegy boolean query for Whole Foods (or quick-launching your search with our pre-built Entity for the brand) you’ll receive the data endpoints within seconds, laid out in the Overview. The first page also displays the Social Persona data for your search results. You’ll find a dedicated Interests tab on the left (Figure 1).

Figure 1: Social Persona for audiences discussing Whole Foods: Infegy Atlas data.

Once you navigate to the Interests tab you’ll find analytics that are collected by cross-referencing historical conversational data from online audiences with more than 300 lifestyle and interest categories.

Figure 2 displays the top interests for people who converse about Whole Foods online over a six month period beginning in April 2022.

Figure 2: Top Interests within the conversation on Whole Foods; Infegy Atlas data.

According to the analysis above, people talking about Whole Foods online also frequently discuss topics such as food and drink, desserts and baking, cooking, vegan diets, and world cuisine.

Infegy social listening data is different from other social media monitoring and listening tools because it is based on what people actually discuss and are passionate about online.

Many social media analysis tools will only incorporate “interest” data based on users are connected (e.g. who they follow on social channels), rather actual, comprehensive online behavior and conversation.

From the point displayed above, you can slice and dice the data, pull up different types of data visualizations, and get granular to glean all kinds of information and key details about your target audience.

Let’s take a closer look at the second category listed in the top Interests list (Figure 2): 12.6% of the people who talk about Whole Foods also discuss desserts and baking; they do so with 98% positivity.

This indicates a healthy amount of interest and suggests that we should include “desserts and baking” as an audience interest in a customer profile of Whole Foods.

Activating your social listening platform for audience intelligence

Within a social listening platform like Infegy Atlas, the same query will reveal several further data points about your target audience – in this case, people discussing Whole Foods.

If you navigate to the demographics tab, you’ll see that there is a slightly larger female voice for Whole Foods (Figure 3).

Figure 3: Demographics on the Whole Foods conversation; Infegy Atlas data.

You can easily dive further for insights into the female conversation: clicking on the Female percentage will reveal a button that filters the conversation to only posts from authors who identify themselves as female (Figure 4).

Figure 4: Age distribution of the female voice in the conversation; Infegy Atlas data.

You see here that the largest audience for Whole Foods appears to be women ages 25-34 and 35-44, closely followed by women in the 45-54 age-group. Their conversation indicates a rising interest in fresh foods, recipes, and Whole Foods’ new online hub, the Resolution Renovator.

Because this social listening data is made up of unsolicited, unbiased information with a large sample size, we can rely on this information as strong indicators of our buyer personas.

This means that the broader brand can apply this across the company’s business efforts.

If you were on Whole Foods’ advertising team, you could create strategies for your ad planning and placement based on your audience’s interests. Maybe you would determine that placing ads on baking blogs, fitness and holistic living websites, or on cooking television networks is the way to go in order to reach this audience segment.

As a member of Whole Foods’ social team, you could incorporate this into your social media strategy, leveraging content that used a lot of visuals of desserts.

Using social listening, you could check in on your audience’s social media behaviors and confirm that your strategy is on point. Whole Foods could measure the effectiveness of their Instagram strategy using social listening.

Data above already show that their largest audiences are women between the ages 25 and 44 who have a significant interest in baking and desserts. Now, all you have to do is check in on the conversation on Instagram.

Top social listening tools will provide you with several key filters, such as:

- Demographics

- Age segment

- Channels (such as Instagram, Twitter or blog posts)

- Categories

- Entities (such as companies, people, influencers, brands and products)

- Time

- Geography

To determine if a strategy on a particular channel is working, you could apply a Channel filter to the query: here, you would focus on the conversation around Whole Foods by solely Instagram users (Figure 5).

Figure 5: Social persona of the audience on Instagram; Infegy Atlas data.

As you see from the persona overview above, the Whole Foods Instagram audiences’ median age, gender and interests line up to demographic data in the general research into Whole Foods, suggesting that the Instagram social strategy is aimed squarely at a target audience.

You just saw how you can better understand your audience’s interest and then how to use those interests to develop brand strategies. People’s interests clearly motivate their behavior and are a big factor in what drives them to act.

Keeping track of your audience’s on an ongoing basis across all the different channels and touchpoints, by using the many filters and search parameters in a social listening tool, will be invaluable in helping you better understand your audiences and what interests them.

Understanding what target audiences are passionate about

You can dig further into your target audiences to understand not only what they are interested in but also what they are passionate about, what they view positively and negatively and the emotions they associate with certain topics, brands or products.

Let’s take a look at a specific passion point for our Whole Food audiences.

First, using the scatter plot chart in the Interests data, we can identify a data point that seems to stand out on the chart. In our Whole Foods audience research, we once again see that Whole Foods’ audiences are interested in vegan food. According to this Infegy social intelligence, people who discussed Whole Foods are 4.3x times more likely to be interested in vegan food than the average person posting online (Figure 6).

Figure 6: Top Interests- scatterplot; Infegy Atlas data.

We can then dive into this specific audience segment to discover what it is that makes people who are vegan or interested in vegan food so passionate about Whole Foods.

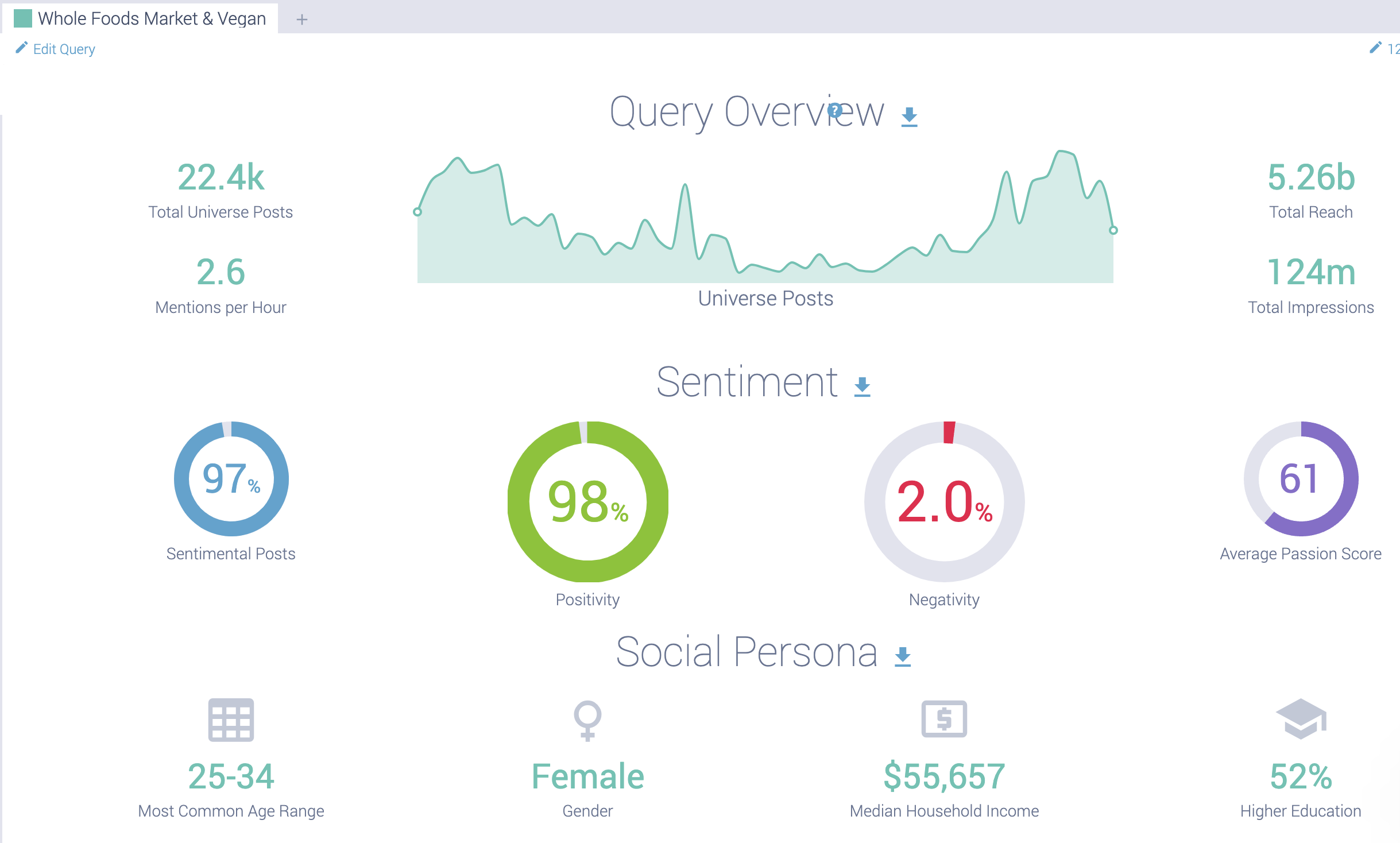

Running the query again, this time looking at people who discuss both Whole Foods and “vegan,” we acquire a new, more specific social persona for this audience segment (Figure 7).

Figure 7: Overview of the audience segment discussing "vegan" within the Whole Foods conversation; Infegy Atlas data.

Looking at the results we see a few key details. First, there are over 22,000 people discussing Whole Foods and “vegan” online.

That’s a pretty sizable post volume, which tells us this is a popular topic among Whole Foods audiences. You will also see that the potential reach for this topic is up to 5.26 billion people, meaning that millions of people viewed and interacted with content related to this brand and topic.

Consumer sentiment towards Whole Foods when discussing topics around “vegan” is very high: 98% of user created content was positive! We can dive even further via the Sentiments tab to learn more about audience passions and emotions when it comes to this conversation.

Infegy passion score measures the intensity with which the individual discusses the topic, essentially measuring whether people posting feel strongly about the subject they’re discussing. The average passion score for this topic is 61, which is high.

Even more noteworthy are the joy and trust audiences display when discussing Whole Foods and “vegan” together: Infegy Sentiment data shows Joy at 59% and Trust at 49% (Figure 8).

Figure 8: Emotions analysis; Infegy Atlas data.

At this point you may wonder what specific topics or events get your audiences talking. Using the Infegy Trends tab, you can view Passion trends over time for the audience discussing the brand and “vegan.” The trends show us a passion score of 100 the week of June 5th, 2022. You can zoom straight to the top posts during that range (Figure 9).

Figure 9: Passion trends; Infegy Atlas data.

A quick review of the top posts showed us that audiences were passionate about new vegan frozen treats and other new vegan products that Whole Foods made available to their customers over the summer of 2022.

This data can be used to inform future strategies and also plan out specific messaging, content, events and campaigns for their vegan audience base.

Conclusion

Adding all of this up, you have a really good picture of your target audiences laid out thanks to this social media intelligence.

What people talk about is a key indicator into what they will do as a potential buyer. Adding consumer intelligence from social media to your market research matrix will help you document a much more accurate, real-time overview of your target audiences and help you analyze what those audiences are interested in. In other words, social listening can help you further build passionate customers.

To learn more about your audience’s interests and passions sign up today for a custom demo of our social listening tool, Infegy Atlas.

Share this

- December 2025 (1)

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (2)

- July 2025 (2)

- June 2025 (1)

- April 2025 (4)

- March 2025 (4)

- February 2025 (2)

- January 2025 (2)

- December 2024 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (3)

- August 2024 (4)

- July 2024 (2)

- June 2024 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (3)

- February 2024 (3)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (3)

- September 2023 (3)

- August 2023 (4)

- July 2023 (4)

- June 2023 (2)

- May 2023 (4)

- April 2023 (4)

- March 2023 (4)

- February 2023 (4)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (3)

- September 2022 (3)

- August 2022 (2)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (2)

- November 2020 (1)

- October 2020 (2)

- September 2020 (1)

- August 2020 (2)

- July 2020 (2)

- June 2020 (2)

- April 2020 (1)

- March 2020 (2)

- February 2020 (2)

- January 2020 (2)

- December 2019 (2)

- November 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (2)

- July 2019 (1)

- June 2019 (1)

- May 2019 (2)

- March 2019 (2)

- February 2019 (2)

- January 2019 (1)

.png?width=64&height=64&name=linkedin%20(1).png)