Share this

Validating Dunkin's Influencer Marketing Budgets

by Henry Chapman on Nov 18, 2022 12:00:00 PM

Dunkin’s expansion from localized geography

Dunkin’ began outside of Boston, Massachusetts. By attaching their brand to beloved Massachusetts institutions like the New England Patriots and the Boston Red Sox, Dunkin’ integrated their brand into the mornings and breakfasts of millions of Americans. Infegy Atlas’ geographic post volume shows this concentration in the northeast. While Krispy Kreme is a more national brand, Dunkin’ controls the regional donut-related post volume in New England.

Dunkin’ did not stop at conquering a regional market; they began investing in social media advertising.

In this brief, we will show how Dunkin’s first-mover advantage and influencer marketing has overwhelmed Krispy Kreme, their leading competitor, and has pushed their brand into the national spotlight.

Figure 1: Geographic post volume of Krispy Kreme related content versus Dunkin’ related content; Infegy Atlas data.

Summarizing Dunkin’s and Krispy Kreme’s business strategies

Dunkin’ and Krispy Kreme make roughly the same annual revenue ($1.384 billion for Krispy Kreme versus Dunkin’s $1.25 billion). However, they operate with very different marketing strategies.

Dunkin’ is a relatively localized brand, with 70% of their stores in the Northeastern United States. Krispy Kreme has 485 stores, concentrated in the south, but spread widely across the United States.

While Dunkin’ far outnumbers Krispy Kreme when it comes to brick-and-mortar locations, Krispy Kreme has better grocery store penetration, which explains their equivalent revenue streams.

Dunkin’ superior social presence

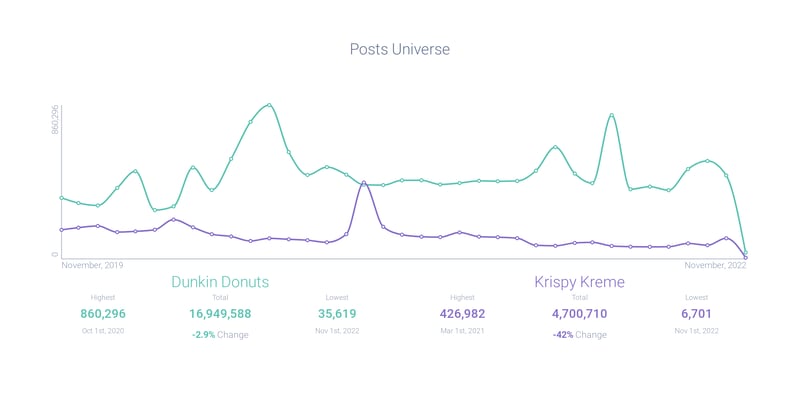

Despite being regionally constrained, Dunkin’ post volume is 360% higher than Krispy Kreme’s post volume online.

Additionally, Dunkin’ has captured 97.5% of TikTok-sourced post volume over the last two years. As we will explore below, they achieved this by partnering with leading influencers and investing in TikTok before their other competitors.

Figure 2: Post volume trend graph comparing Krispy Kreme-related volume versus Dunkin’-related volume; Infegy Atlas data.

Dunkin’s TikTok coup: Getting in early

Dunkin’ moved quickly and began creating a TikTok presence in 2020, as the platform began rapidly gaining popularity amongst its Gen Z target demographic. They were the first breakfast coffee chain to get into TikTok.

This move mirrored their proactive stance on Instagram, where Dunkin’ was one of the first brands to take advantage of advertising on the social media network. Infegy’s historical dataset for Instagram (dating back to 2016) reveals consistently high Dunkin’-related post volume on Instagram (Figure 3). TikTok post-volume emerges in 2020 when the brand launched its TikTok presence.

As a result of their first-mover advantage, Dunkin’ amassed massive follower counts. Dunkin’s TikTok account boasts 3.1M followers, compared with Krispy Kreme’s 40,000.

Figure 3: Channel volume shows consistent Dunkin’ investment in Instagram and a transition to TikTok in 2020; Infegy Atlas data.

Dunkin’s TikTok coup: Investing in the right influencers

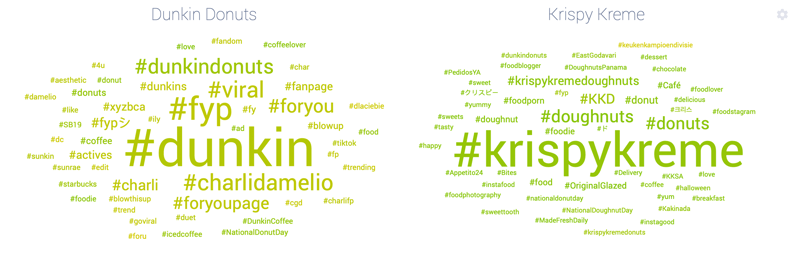

With Dunkin’s early-mover advantage into TikTok, they were able to learn about which influencers audiences reacted to the most. This intelligence allowed them to win over Charli D’Amelio, the most followed person on TikTok in 2020. D’Amelio had been posting organic Dunkin’-related content, so a sponsored partnership made sense for both actors.

After a few months of the partnership, Charli-related messages took over Dunkin’-related hashtags on the platform. This has allowed Dunkin’ to expand their reach by partnering with such a high-profile influencer. Krispy Kreme, on the other hand, didn’t make those influencer moves, and thus doesn’t have the same exposure.

Figure 4: Hashtag word cloud showing heavy presence of influencer-related hashtags with Dunkin’, but not with Krispy Kreme; Infegy Atlas data.

Measuring Dunkin’s social media success ROI

Dunkin’ has overwhelmed all other donut and coffee-related post volume on social media. Infegy Atlas, using state-of-the-art theme detection, shows that the increased post volume and influencer-pairing has translated to higher intent-to-purchase for Dunkin’ versus Krispy Kreme. That means that social media users posting about Dunkin’ are more likely to express a desire to buy coffee or snacks from the brand versus Dunkin’s leading competitor.

Figure 5: Infegy Atlas Intent-to-Purchase theme shows that Dunkin’-related post volume is more likely to showcase the users’ intent to purchase; Infegy Atlas data.

Conclusion

In this brief, we showed how Dunkin’ is evolving from a regional, Northeastern breakfast fast-food brand, to a global internet phenomenon. They accomplished this by investing early in breakthrough social media networks like Instagram and TikTok. They used that first-mover advantage to partner with Charli D’Amelio, a leading influencer on TikTok, to dramatically expand their reach.

Dunkin’s social media strategies have translated to higher sales, measured via Infegy Atlas’ Intent-To-Purchase theme.

The techniques employed here by Dunkin’ can work for any brand that has the proper consumer intelligence toolset. Being able to gain insights around what consumers want, and which channels are utilized by specific audience segments is the type of consumer social intelligence that is critical to any company’s growth strategy.

Share this

- October 2024 (2)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (6)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)