Share this

Pharma Music Jingles Boost Brand Recognition

by Henry Chapman on April 4, 2024

Understanding the success of pharmaceutical musical ad campaigns

In the United States, pharmaceutical companies invest heavily in musical jingles within their advertising campaigns to create memorable experiences. They do this for two reasons: first, music has a powerful effect on memory and can make an ad more likely to be remembered, and second, a catchy tune can differentiate a product in the highly competitive pharmaceutical market. These jingles represent these companies' "pull-up" strategies, or getting the consumer to talk to their doctor about medications and conditions versus targeting the doctors themselves for a "push-down" strategy.

The success of these "pull-up" campaigns like those for Jardiance and Skyrizi, which have become almost synonymous with their jingles, illustrates the effectiveness of this approach. Meanwhile, Ozempic demonstrates how a product's market presence can eventually transcend its musical origins, although the initial boost from its jingle likely contributed to its widespread recognition.

Pharmaceutical advertising investments comprise the second-largest TV and digital advertising spending category in the United States. With billions of dollars at stake, these companies have developed extensive social listening practices to monitor the public reaction to that spending and determine how well those advertisements have broken through the public consciousness. We'll look at three of the most extensive pharma advertising campaigns in the United States today: Jardiance (Type-2 diabetes), Skyrizi (Crohn's disease and plaque psoriasis), and Ozempic (Type-2 diabetes). We'll show you how using the traditional advertising jingle, Ozempic, Skyrizi, and Jardiance are inextricably linked to their musical jingles.

Overall pharma ad post volume

As is tradition, we'll start with an overall view of post volume across each drug. Your first takeaway should be just how much attention social media spends on Ozempic, a medication used to improve Type 2 diabetes with the unintended side effect of weight loss. We started covering Ozempic last year, and its growth has skyrocketed since then, with a 1,148% growth rate since the beginning of our sample.

Jardiance and Skyrizi have much lower post volumes than Ozempic. However, Jardiance has a high growth rate over the period, at 828% positive growth since March 2022. Skyrizi had comparably flat growth throughout our sample time with only 49%.

-1.png?width=800&height=369&name=Image%201%20-%20Comparative%20Post%20Volume%20(1)-1.png)

Figure 1: Comparative post volume across Jardiance, Skyrizi, and Ozempic (March 2022 through March 2024); Infegy Social Dataset.

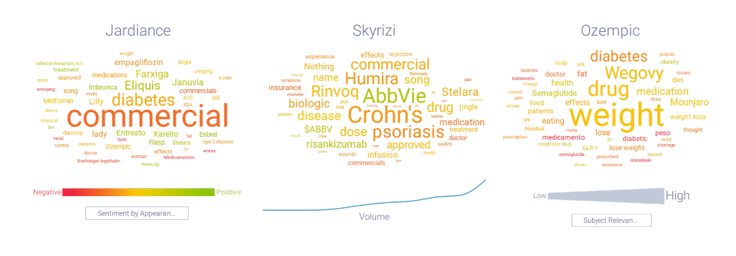

Breakthrough ad campaigns for the drugs with a smaller online footprint

Now that we've examined the post volume growth, let's discuss the underlying words fueling that growth. Remember, our query was just for a generic conversation around these brands. In other words, we weren't targeting a particular branded campaign; we were looking at posts mentioning these three drugs. Figure 3 shows that Jardiance and Skyrizi mention that their commercials "broke through" the underlying conversation with the highly featured word “commercial”. Breakthroughs are highly significant within the social listening space, as they are visceral proof that your musical advertising campaign is having an effect. "Commercial" was the most prevalent topic attached to Jardiance.

On the other hand, we didn't see any topics related to Ozempic's musical advertisement. We looked more extensively at the Ozempic conversation and found it there, but you had to search for it. Paradoxically, this is an excellent sign for the marketing folks over at Ozempic - it means that their product has reached a point of recognition that it has outgrown its advertising campaign.

Figure 2: Comparative topics across Jardiance, Skyrizi, and Ozempic (March 2022 through March 2024); Infegy Social Dataset.

Hashtags attributed to each advertising campaign for more attribution clarity

Let's explore hashtags to gain a deeper understanding of the underlying granular topics people discuss when they mention each of these brands. We corroborate our findings above regarding Ozempic. Most post volumes revolve around Ozempic weight-loss conversation, with a tiny percentage about advertising campaigns or Type-2 diabetes. We also note the prevalence of competitor hashtags like "#mounjaro" and "#wegovy."

Figure 3: Ozempic-related hashtags (March 2022 through March 2024); Infegy Social Dataset.

Compared with Ozempic, Skyrizi, and Jardiance, hashtags are much more branded (and targeted in their musical commercials). Interestingly, we see co-branded hashtags (specifically TV shows like #househunters and #bachelorinparadise, where drug advertisements appear). We examined the underlying posts, and most seemed to be organic (e.g., TV viewers talking about the Skyrizi and Jardiance commercials). This type of musical commercial shows how your ad can break through the noise.

Figure 4: Skyrizi-related hashtags (March 2022 through March 2024); Infegy Social Dataset.

Takeaways for your brand

Pharmaceutical companies' investment in musical jingles is a powerful tool for creating memorable brand associations and distinguishing their products in a competitive market. The success of campaigns for Jardiance and Skyrizi underscores the effectiveness of these "pull-up" strategies, which aim to encourage consumers to initiate conversations with healthcare providers about medications and conditions. Ozempic, on the other hand, has such societal reach that organic conversation has overwhelmed their more branded content. Pharma brand strategists must know the underlying patterns and buzz surrounding their ad campaigns to validate their spending. Social listening tools like the Infegy product suite can help hear this buzz across branded and unbranded channels.

Pharmaceutical Advertising Success with Musical Jingles

Pharmaceutical companies leverage catchy jingles to enhance brand recall and differentiate in a competitive market. Campaigns like Jardiance and Skyrizi prove the success of "pull-up" marketing, prompting consumer-initiated discussions with doctors. Ozempic's market recognition has grown beyond its jingle, indicating wide public awareness.

Social Media Impact on Pharma Advertising

Ozempic's social media mentions have surged, with a 1,148% growth rate, overshadowing other drugs. Jardiance and Skyrizi show significant social media discussions, proving the importance of engaging advertising strategies.

Breakthrough Ad Campaigns and Online Conversations

Jardiance and Skyrizi's ads are frequently mentioned in online discussions, highlighting the effectiveness of their campaigns. Ozempic has achieved high recognition, showing less need for explicit ad mentions.

Hashtag Analysis for Brand Visibility

Ozempic's discussions center around weight loss, while Skyrizi and Jardiance enjoy targeted brand engagement. Co-branded hashtags with TV shows enhance visibility, exemplifying how musical ads capture consumer attention.

Takeaways for Pharma Brand Strategy

Investing in musical jingles fosters memorable brand associations and encourages consumer-initiated conversations about treatments. Pharma brands must leverage social listening tools to validate advertising strategies and capture campaign buzz.

Share this

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (6)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)