Share this

FTX Collapse: Impact on Investors, Influencers, and Brands

by Henry Chapman on December 21, 2022

Using social media intelligence to measure the fallout of crypto’s largest bankruptcy

FTX, the second largest cryptocurrency exchange in the world by volume, collapsed and declared bankruptcy in November 2022. The first section of this brief will tell the story of how that collapse played out on Twitter over just a few days. The second part of this brief will outline the ramifications of this collapse, specifically as it impacta small investors, financial influencers, and large brands.

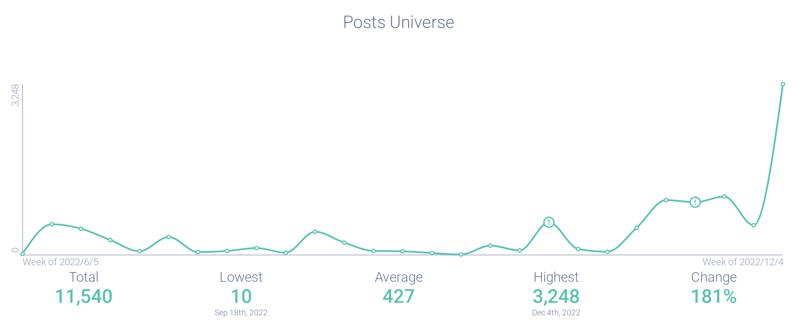

Bitcoin and other cryptocurrencies rode to a high in November 2021, buoyed by cheap interest rates and an investing public that was flush with stimulus cash. That high began to collapse in early 2022 with increasing economic uncertainty, rising interest rates, and growing inflation. As investors moved away from more speculative assets, large cryptocurrency exchanges like Celsius, Voyager, and BlockFi went bankrupt. Even more mainstream crypto exchanges like Kraken, Coinbase, and Gemini have laid off thousands of their employees. This graph shows that conversation around “cryptocurrency layoffs” has surged 181% in the last six months.

Figure 1: Post volume for “cryptocurrency” and “layoffs” over the last six months; Infegy Atlas data.

Initial events leading up to collapse

Coindesk, a leading cryptocurrency news publication, published a report on November 2, 2022 alleging that Alameda Research, a trading company also owned by FTX’s founder and CEO Sam Bankman-Fried, held a particularly large amount of FTT tokens, a cryptocurrency created by FTX. Alameda holding these tokens was controversial: it was essentially investing self-created money. Coindesk further alleged that Bankman-Fried was using customer accounts to replace money Alameda Research had lost, despite reassuring customers that their accounts would not be invested without their express permission. This article spread like wildfire on Twitter and caused many investors to panic and try to withdraw their money.

Figure 2: Post volume showing the spread of Coindesk’s article; Infegy Atlas data.

Figure 3: Screenshot of Coindesk’s article; Infegy Atlas data.

Binance attempts to intervene

Changpeng Zhao, the CEO of a rival exchange, Binance, said that Binance would be selling all of its FTT tokens on November 6 due to the increased risk associated with FTX’s token. He offered to acquire the struggling FTX two days later if FTX successfully passed through a Binance-led due diligence check. Binance’s auditors quickly realized that FTX was short $8 billion. As a result, Binance pulled out of the deal, and FTX was forced to declare bankruptcy. Sentiment around Binance dropped 40%, as FTX investors complained that no promised bailout would come.

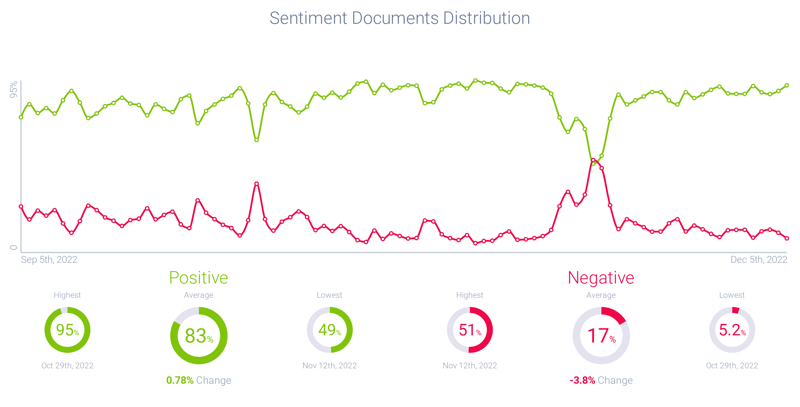

Figure 4: Binance’s sentiment over the last six months; Infegy Atlas data.

Ramifications for smaller investors

Tragically, those holding smaller accounts at FTX are likely to feel the most pain. When looking at Narratives of conversation in FTX’s subreddit, the three largest clusters of conversation relate to opening customer support tickets, questions on withdrawing money, and dashed hopes with regards to a potential Binance bailout. Unlike larger banks and investors, smaller retail investors are less likely to be able to recoup loss and have less bargaining power at the bankruptcy table.

Figure 5: Narratives force graph of FTX’s subreddit showing how retail investors have been hurt by its collapse; Infegy Atlas data.

Figure 6: Narratives table showing specific growth of withdrawal-related posts in FTX’s subreddit; Infegy Atlas data.

Ramifications for financial influencers

As FTX expanded, they spent millions in sponsorships to financial influencers like Graham Stephan (4.1 million YouTube subscribers) and Andre Jikh (2.2 million YouTube subscribers). Via affiliate links, these influencers made money each time a viewer opened an account with FTX. These influencers failed to mention the financial risks associated with these speculative assets. As a result, with viewers potentially losing thousands of dollars, a reckoning has emerged online with social media users posting about these “gurus” with tremendous negativity.

Figure 7: Word cloud showing terms around Andre Jikh and other YouTube financial influencers in the aftermath of FTX’s collapse; Infegy Atlas data.

Ramifications for large brands

FTX invested in partnerships with brands and celebrities. They signed on NFL Quarterback Tom Brady, NBA giant Steph Curry, and dozens of other sports stars. FTX went so far as to pay for the renaming of the Miami Heat’s stadium to FTX Arena. With FTX’s bankruptcy, many of these large brands and stars are now embroiled in lawsuits led by angry creditors looking to recoup losses. Brands need to be careful about attaching their name to risky assets, lest partnership causes harm to their brand. Social media intelligence is source for reputational data that can inform partnership and endorsement matchmaking.

Figure 8: Word cloud showing negative terms pertaining to Tom Brady in the last three months; Infegy Atlas data.

FTX Crypto Collapse: Key Takeaways

Discover how the FTX collapse unfolded, impacting small investors, influencers, and brands.

FTX Bankruptcy Shockwaves

FTX, once the second-largest crypto exchange, declared bankruptcy in November 2022, creating turmoil in the digital finance world.

Crypto Layoffs Surge

Amid economic uncertainty, crypto layoffs soar 181% as major exchanges like Celsius, Voyager, and BlockFi collapse.

Alameda's Role in FTX Downfall

Controversial Coindesk report reveals Alameda Research's hefty FTT holdings, igniting panic withdrawals among investors.

Binance's Failed Rescue Attempt

Binance CEO's acquisition offer fizzles as auditors uncover FTX's $8 billion deficit, leading to a 40% hit on Binance's sentiment.

Share this

- April 2025 (2)

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (6)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)