Share this

Platforms by Personality

by Henry Chapman on Dec 7, 2023 12:00:00 PM

Figuring out who’s posting on platforms before allocating your ad spend

This is part 2 of a series that pertains to using social listening tools to monitor entire platforms. If you want to read part 1, please take a look here.

When your agency or brand wants to buy ads on a platform, you want to ensure they’re going to social media users you’re explicitly targeting (i.e., people interested in buying your product). The social media platforms make this data hard to access because it can make them look bad (volume or engagement dropping) and because the datasets themselves are so enormous that the platforms cannot provide analysis of their entire dataset.

External tools like Infegy Atlas or Infegy Starscape can fill this gap. We can analyze at the platform level, which means you’re viewing aggregate metrics of billions of posts to guide your ad-buying decisions. We’ll look at the different audiences that hang out on Instagram, Pinterest, and TikTok to show you precisely the eyeballs that would be viewing your ad content if you chose to buy ads on those platforms.

Differing demographics by platform

Let’s take a look at platform-wide demographics. We do this like no other platform can: by collecting this data at the account level. When we add accounts to our dataset, we use advanced AI to predict demographic facts about each account. Looking at the billions of posts that make up an entire platform, we can aggregate these ages to tell you details that no social media platform would willingly give you.

Age

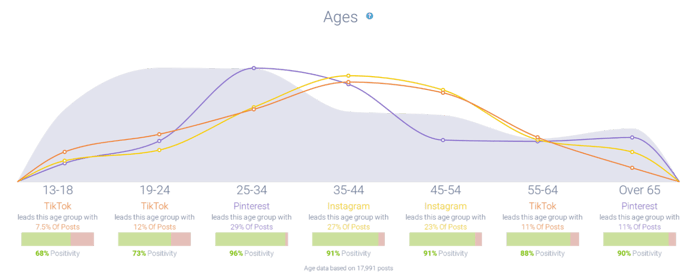

First, we’ll start with age, one of the most basic demographic factors advertisers and brands consider when building audiences. Brands are particularly interested in younger users (specifically Gen Z) because consumers fix their buying habits early in their lives.

Our tools collect age by accounts based on self-reported details in account source bios and post feeds. For example, if someone wishes “Happy 18th Birthday” on their feed, our systems are smart enough to identify the generation associated with that person.

Now, let’s dig into our results. You’ll see a histogram that lines up mostly with expectations, albeit with a few surprises. TikTok dominated the younger demographics and led conversational post volume from ages 13 through 24. This makes sense and falls in line with the common narratives. On the other hand, Pinterest took off for users aged 25-34. Instagram was very popular with Gen Z users (35-54). Surprisingly, TikTok returned as the leader for people aged 55 through 64.

Figure 1: TikTok platform-wide volume metrics; (June 2023 through October 2023); Infegy Starscape data.

This type of platform-level understanding is unique within social listening (and social media space in general). Platforms loathe providing usage numbers themselves lest they show declining usage, which translates to poor stock performance. By relying on third-party datasets like Infegy’s, you can gain data-driven insights into how people themselves are using social media platforms: this allows you to make advertising purchasing decisions, instead of blindly dumping money into Meta or TikTok ads.

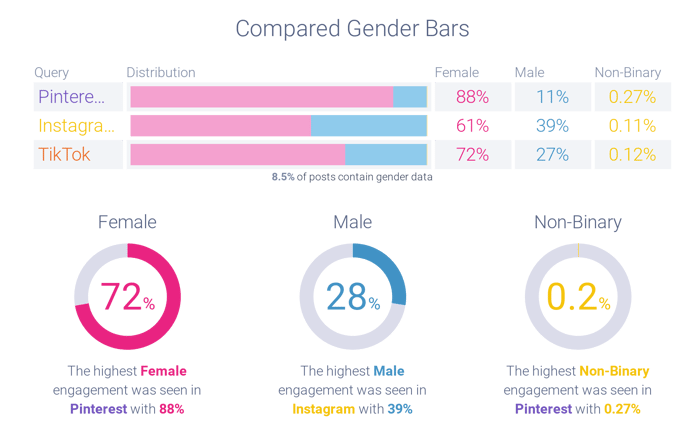

Gender

Next, let’s take a look at gender. Our systems similarly determine this based on source bios and referring pronouns in feeds. While our age histogram wasn’t surprising, platform-wide gender data shocked us. We found that while Instagram tended to skew slightly more female, Pinterest was 88% female, and TikTok was 72% female. These percentages were much higher than we expected, especially when dealing with the enormous datasets that our platforms collect.

These disparities are critically crucial for brands to understand. If you’re building an audience for men or partnering with a male influencer, you need to advertise on Instagram because you’re statistically much more likely to run into men posting on that platform. However, for that same male audience, building content on Pinterest wouldn’t be very helpful because the platform is so dominated by female users.

Figure 2: Gender distribution showing how users gender differs by platform; (November 24, 2023 through November 27, 2023); Infegy data.

Source interests

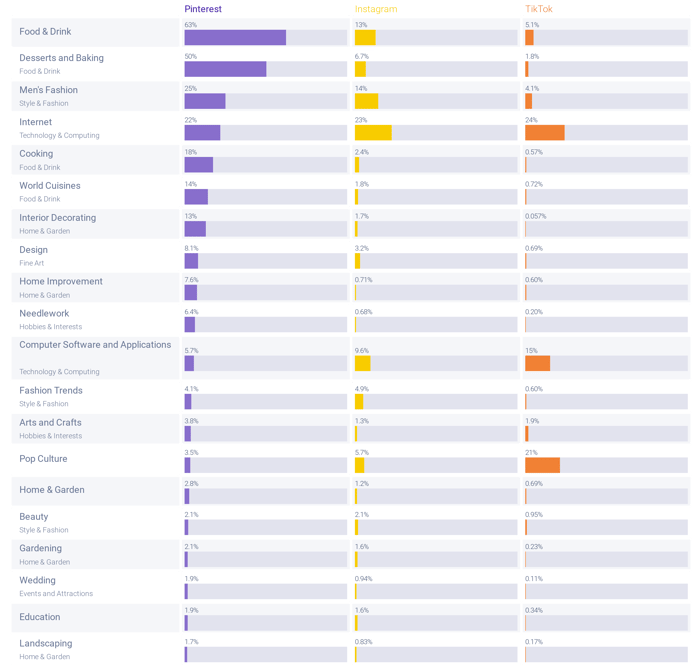

Now that we’ve looked at two of the demographic factors Infegy offers on a platform level, let’s dive deeper into what interests those people. We use topic classification at an account level, meaning we automatically contextualize and aggregate the subjects the account posts about. This aggregation allows us to derive the overall subjects that rise to the top of pertinence for each platform.

In Figure 3, we’re looking at aggregated source interests by platform over the last week. You’ll find that accounts posting about food and drink made up 63% of all posts on Pinterest. This percentage is astronomically high and would drive ad purchasing decisions if your brand or agency resided in the food and beverage industry. Additionally, Pinterest had a high rate of design and home improvement. In comparison, these were less prevalent on TikTok or Instagram. If you’re representing a home improvement client, Pinterest would be the best place to put your ad dollars.

Figure 3: Source interests by platform; (November 24, 2023 through November 27, 2023); Infegy data.

Takeaways for your brand

Leveraging social listening tools like Infegy Atlas and Infegy Starscape provides advertisers with crucial insights for optimizing ad spend. Analyzing age demographics reveals platform-specific patterns, guiding targeted content creation. Gender distribution disparities across platforms emphasize the need for strategic ad placement. Additionally, exploring source interests at an account level uncovers niche content themes, allowing advertisers to align campaigns with platform trends. In a dynamic digital advertising landscape, such data-driven approaches empower advertisers to make informed decisions, maximizing impact and staying ahead in reaching their target audiences effectively.

Share this

- October 2024 (2)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (6)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)