Share this

Tracking Fanduel & Draftkings Growth with Social Media Analytics

by Henry Chapman on November 25, 2022

Using consumer intelligence to monitor sports betting activity

People have been betting on athletic outcomes for as long as people have been playing sports.

Except for a few localized exceptions, sports betting has traditionally been heavily regulated or illegal in the United States. This changed in the last decade when the US Supreme Court opened the door to legalizing online sports betting across the country.

In this brief, we will examine how we used Infegy Atlas to understand how sports betting has rapidly expanded. We’ll then analyze for the target market and key players in the sports-betting arena.

We will conclude this brief with a short discussion on how social listening can highlight the harms of sports betting, specifically the dangers associated with gambling addiction and financial losses.

US Supreme Court legalizes online sports betting

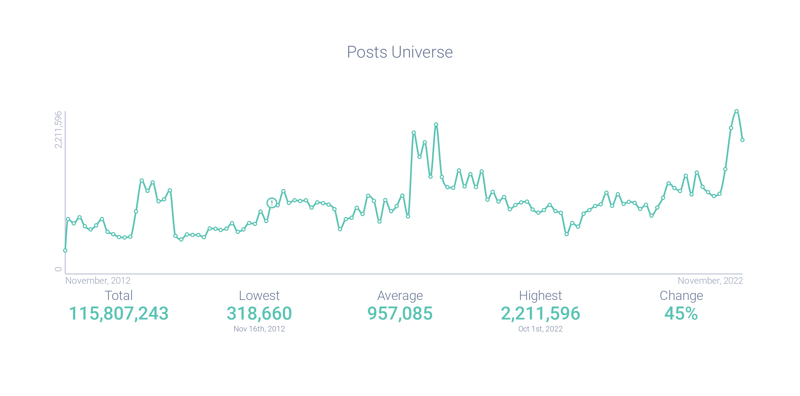

The US Federal Government criminalized sports betting with it’s 1992 Professional and Amateur Sports Protection Act. The US Supreme Court overturned that law in May 2018, declaring it unconstitutional. Consumer intelligence data from Infegy Atlas noted a major surge in post volume around that announcement (depicted below), and a 282% increase in post volume since that announcement. What we can infer from this social listening data is that once online betting was legalized, consumers, and the betting industry in general, surged in to participate in the newly available opportunity.

Figure 1: Post volume graph showing enormous growth of sports betting post volume; Infegy Atlas data.

Using social listening to see the target market

Sports betting has now been legal for over the last five years. We used Infegy Atlas to look at demographics on its target consumer. We found that male voices on social media discussing sports betting outnumbered female voices by almost three to one. In terms of age, 25- to 34-year-olds were most likely to be positive about sports betting. Gen Z social media users were less likely to post about sports betting than 25- to 54-year-olds. We found that people posting about sports betting were likely to have slightly above-average incomes, suggesting that people willing to gamble had some degree of disposable income.

Figure 2: Demographic details showing social media users most likely to post about sports betting; Infegy Atlas data.

Detecting an overlap with crypto-investing communities

We used topic word clouds to highlight topical hashtags that appeared in sports betting-related posts over the last few years. We found an association between users who discuss betting and those who discuss cryptocurrencies.

The connection between these hashtag-clustered conversations suggests that individuals who are willing or able to participate in the risks of sports-betting, are the same ones who make investments in cryptocurrencies, which is also a risky venture.

Figure 3: Topic force graph showing how cryptocurrency related topics appear closely related to gambling-related topics; Infegy Atlas data.

Using Infegy Atlas to show which teams trending positively in betting communities

Using Infegy Atlas’ Entity detection, we can determine which teams are being talked about the most in the context of sports betting.

In the table, you can see that betters were most positive about Manchester United, but were considerably less positive around the Seattle Seahawks.

Figure 4: Infegy Atlas Entities graph showing sports teams most closely related with sports betting related posts; Infegy Atlas data.

Potential dangers: mental health and gambling addiction

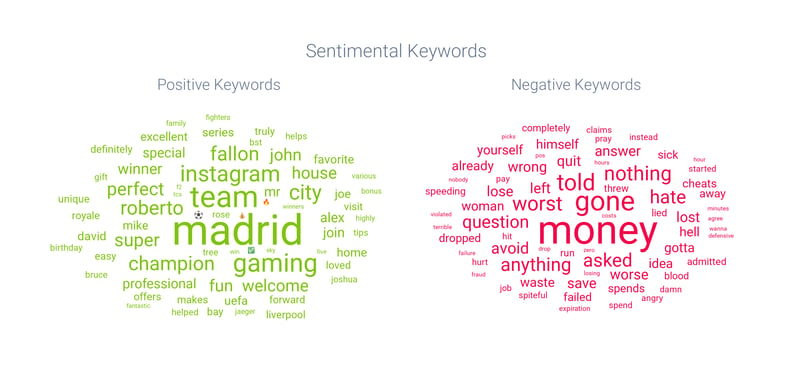

While sentiment around sports betting was positive overall, social listening data keyed us into possible hidden risks. When looking at negative topics, many social media users used terms like “money,” “gone,” “nothing,” and “quit.” A Pew Research article from July 2022 notes that sports-betting addiction is the fastest growing addiction in the United States. For those monitoring community health and addiction, this could be particularly concerning, especially because of how available online sports betting is: gamblers can wager thousands of dollars with just a few taps on their phone.

Figure 5: Positive and negative topics associated with sports betting related posts; Infegy Atlas data.

Conclusion

In this brief, we looked at how social listening and consumer intelligence data can deliver insights into the opportunities and risks of emergent sports betting industry.

We looked at how post volume has surged since the US Supreme Court legalized it in the United States. Next, we looked the current target audience of sports-betting (25- to 55-year-old males). Further demographic analysis with Infegy Atlas revealed an audience segment of primarily middle-aged men who are also interested in crypto investing.

Subsequently, we looked at how Infegy Atlas can identify teams that are being mentioned most frequently within betting related posts. Finally, we discussed how social media users are posting about their gambling losses online.

Explosive Growth in Sports Betting Industry

Legalization by the US Supreme Court in 2018 spurred a 282% rise in online sports betting activities, as reported by Infegy Atlas.

Target Audience: Who's Betting?

Primarily composed of 25- to 34-year-old males with above-average incomes, the sports betting demographic is actively engaging on social media.

Link Between Sports Betting & Crypto Community

Social listening data reveals a notable overlap between individuals interested in sports betting and those engaging in cryptocurrency discussions.

Top Teams in Betting Conversations

Manchester United leads positive sentiment in betting circles, while opinions on the Seattle Seahawks are considerably less favorable.

Risks in Sports Betting: A Hidden Concern

Despite overall positive sentiment, issues like gambling addiction and financial losses are significant concerns, highlighting risks within this industry.

Share this

- December 2025 (2)

- November 2025 (2)

- October 2025 (3)

- September 2025 (2)

- August 2025 (2)

- July 2025 (3)

- June 2025 (3)

- May 2025 (4)

- April 2025 (2)

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (3)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (7)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)