Share this

Millennials Are Building, Not Buying, New Homes

by Henry Chapman on September 27, 2023

Social listening reveals how millennials are building, rather than buying, new homes

Buying a home has been a significant milestone for many young adults in their twenties and thirties in the United States. But nowadays, homebuying has become incredibly difficult. Home loan interest rates are increasing, and there are fewer houses available due to limited construction and zoning limitations, a hangover from the Great Recession of 2008. Mainstream news outlets have covered how millennials and Gen Z have gotten very anxious about their home-buying prospects. However, after looking at the data, we've found that while a considerable percentage of home-buying conversation comes from younger Americans, the talk is less negative than the mainstream news would lead you to believe. In fact, millennial Americans are surging into new home builds. This insight highlights a well-known use case for social listening data: using it to prove or disprove familiar narratives in the news.

We're incredibly excited about this piece because we're introducing data visualizations created with our upcoming Infegy Starscape API. This newest iteration enables custom nested aggregations, something that was previously unavailable. In data science or databases, aggregation means taking a bunch of information and grouping it together to get useful summaries. Within our social dataset, we have tons of fields (source age, source gender, publish date, etc.). With our new API, we can gather all the posts that are of the same type like people aged 20-40. We can then generate stats (count, mean, median, percentile, etc.) based on these different groups. Custom aggregations mean we can tell better and more flexible stories with even larger and more diverse datasets.

Surging post volume by age

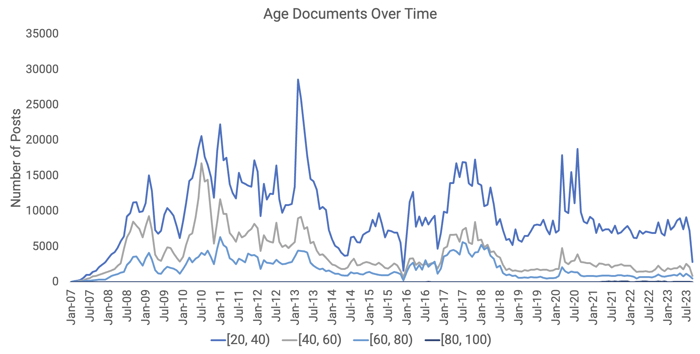

Let's start by looking at how many posts people of different ages have made about home buying. We can do this thanks to Infegy Starscape's all-new API, which enables nested aggregations across any of our database's fields. In the graph below, we've divided the posts made over 16 years on all of Infegy's social channels into four age groups: 20 to 40, 40 to 60, 60 to 80, and 80 to 100.

Figure 1: Aggregated age breakdown by month using Infegy's new Starscape API (2007 through 2023); Infegy Starscape data.

Here are three takeaways from this graph:

Positivity associated with younger social media users

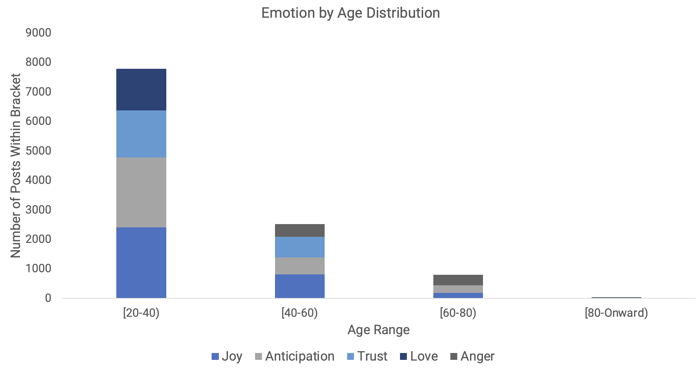

Now that we've examined the overall number of posts, let's delve into how Emotions vary across different age groups. We can do this thanks to Infegy Starscape's custom groupings. In Figure 2, we analyze how frequently posts from each age bracket express specific emotions. In this analysis, we're not just counting the number of posts but looking at how common a particular Emotion is within each age group.

For the youngest age group, we noticed that they primarily expressed positive emotions like Joy, Anticipation, Trust, and Love. Anticipation, in particular, was the most common emotion, appearing in 30% of their posts. However, as we move to older age brackets, we see Anger becoming more prevalent. It's present in 20% of posts for individuals aged 40 to 60 and nearly 50% of posts from those aged 60 to 80. These percentages challenge the common belief that millennials are overwhelmingly pessimistic about home-buying.

Figure 2: Aggregated Emotion distribution by age range using Infegy's new Starscape API (2007 through 2023); Infegy Starscape data.

Narratives reveal interest in new home builds

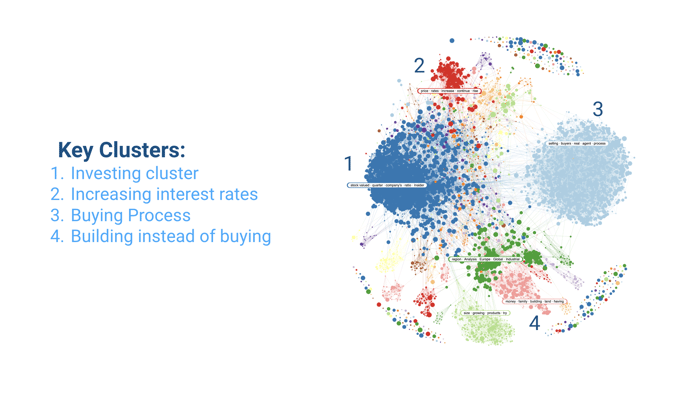

We wanted to understand the positivity associated with millennial home buying. To do so, we turned to Narratives to get a better feel for the conversational context. Narratives links topics across disparate documents to build clusters of conversation. We found many of the clusters you'd expect around home buying - the most significant cluster dealt with investment performance. In contrast, another cluster talked about buying a home in the landscape of rising interest rates.

However, we also found a cluster about potentially building a home versus buying one. Interestingly, this cluster had a median age of 34 and a positivity rating of around 80%. This median age is precisely within our target research demographic and helps explain why millennial home buyers are more favorable than expected. Millennials building instead of buying older homes is becoming a common trend within real estate.

Figure 3: Narratives associated with home buying (2018 through 2023); Infegy Atlas data.

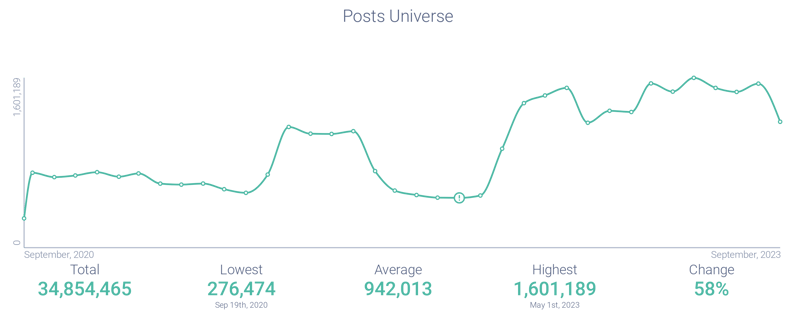

New home builds post volume

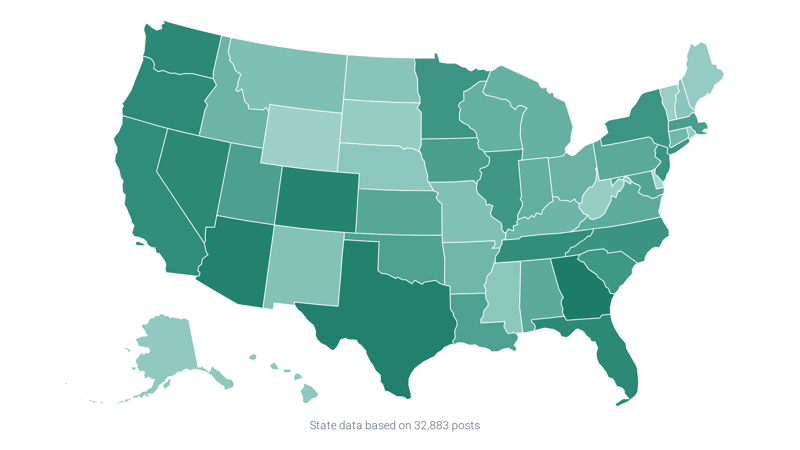

We wanted to look into this trend. We searched for conversations of new home builds and found a 60% surge in post volume since September 2020. This finding matches what the press has widely reported in states like Iowa, Texas, and Arizona. Interestingly - social listening data corroborates the interest in those states as well. We found surging post volume in each of those around the topic.

In the world of rising interest rates, people locked in mortgages at 2-3% are unwilling or unable to move and give up those rates. As a result, there are much fewer used homes on the market. Millennials are turning to new home construction to meet their housing needs.

Figure 4: Post volume associated with new home builds (2020 through 2023); Infegy Atlas data.

Figure 5: Post volume by state associated with new home builds (2020 through 2023); Infegy Atlas data.

High millennial positivity

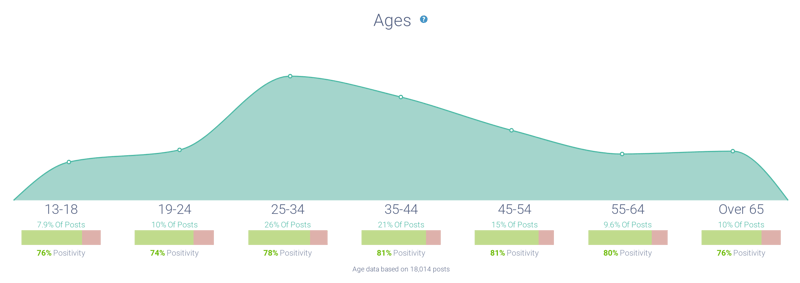

To corroborate our hunch that the driving force behind this new home build positivity is coming from millennials, we looked at the age distribution attached to this query. We found that 25 - 44-year-olds comprised 47% of the post volume attributed to new home building. We also found that 35-44-year-olds lead the positivity score with 81%.

Figure 6: Age distributions associated with new home builds (2020 through 2023); Infegy Atlas data.

Takeaways for your social listening practice

Our analysis of millennial home buying trends through social listening data uncovered a surprising and more positive perspective than commonly portrayed. This data challenges prevailing narratives, showing that millennials and younger generations actively engage in home-buying discussions that often express positivity. We've also identified an emerging trend: millennials' growing interest in new home construction. Social listening provides a powerful lens through which we can gain deeper insights into customer behavior, enabling us to make informed decisions and stay ahead of the curve in a rapidly changing market landscape, knowledge that is especially for real estate companies, or any businesses looking to cater to their evolving customer preferences.

Millennials Turn to New Home Construction

Millennials are shifting from buying to building new homes due to high interest rates and limited housing availability, defying the typical home-buying narrative. Expanded social listening uncovers their optimistic outlook and highlights their prominent role in the home construction surge.

Positive Emotions Dominate Millennial Discussions

Social listening reveals younger age groups are more positive about home buying, expressing emotions like joy and anticipation. Contrary to popular belief, millennials show far less pessimism than expected, with anger rising in older age brackets.

Emerging Trend: Millennials Building Instead of Buying

Amid rising interest rates, millennials, notably ages 25-44, show increasing interest in new home construction over purchasing existing homes. Social data confirms this growing trend, highlighting significant positivity in these discussions.

Social Listening: A New Lens on Trends

Social listening challenges negative perceptions surrounding millennial homebuyers, providing valuable insights into market behaviors and emerging trends. Businesses, especially in real estate, must leverage this data to adapt to evolving customer needs and preferences.

Share this

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (6)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)